As companies continue to expand their global development teams, Latin America has emerged as a strategic region for sourcing high-quality software talent. With strong time zone alignment to North America, cultural compatibility, and a maturing remote work infrastructure, LATAM offers both cost efficiency and engineering depth.

In fact, the Latin America IT market is projected to grow at a 6.5% annual rate through 2030, signaling continued demand for skilled technical professionals and increasing investment across cloud, cybersecurity, DevOps, and AI. This growth reinforces the region’s appeal not only as a nearshore destination—but as a long-term tech partner.

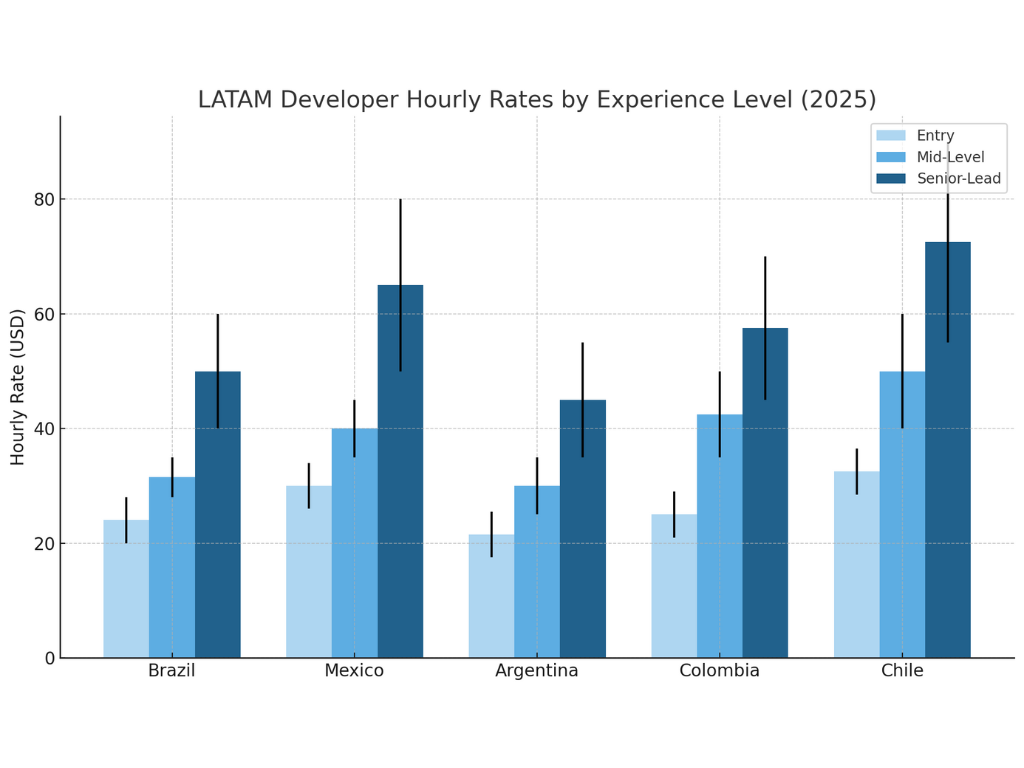

In this post, we break down current (2025) hourly developer rates across five major LATAM markets—Brazil, Mexico, Argentina, Colombia, and Chile—based on experience level. You’ll also find insights into local market dynamics, salary structures, and what influences developer compensation beyond just geography.

What to Expect from LATAM Developers

Beyond competitive pricing, LATAM developers bring a strong mix of technical, educational, and cultural strengths to distributed teams:

- Educational depth: A significant percentage of engineers—such as 68% in Colombia—hold Bachelor’s or Master’s degrees, often in computer science or engineering disciplines.

- Modern tooling and practices: Developers are quick to adopt new frameworks, cloud platforms, and DevOps practices, making them productive in modern agile environments.

- Cultural compatibility: Developers in LATAM are fluent in U.S. business norms and typically operate within U.S. working hours, enabling smooth integration with North American teams.

- Work-life balance and retention: The region is also known for a healthy work culture, contributing to better long-term retention and sustainable productivity.

Average Hourly Rates by Country

Developer compensation across Latin America varies significantly by experience level. The most recent data reveals clear distinctions between entry, mid-level, and senior-to-lead roles. Below is a breakdown of typical hourly rates in five leading LATAM countries, organized by role seniority:

- Entry: Developers with 0–3 years of experience, typically responsible for writing core features, bug fixes, and contributing to projects under the guidance of more senior engineers.

- Mid-Level: Engineers with 3–5 years of experience who can work autonomously, deliver complete features, integrate APIs, and make architectural recommendations within established frameworks.

- Senior: Seasoned developers with 5+ years of experience, often managing complex systems, leading teams, setting architectural direction, and ensuring code quality at scale.

LATAM Developer Hourly Rates by Experience Level (2025)

- Junior: Contractors earn ~2–4× more than local pay

- Mid-Level: Contractors earn ~2–3× more than local pay

- Senior: Contractors earn ~2–5× more than local pay

Free Guide: Hire Top LATAM Developers

We’ve prepared this guide that covers benefits, costs, recruitment, and remote team management to a succesful hiring of developers in LATAM.

Fill out the form to get our guide.

LATAM Developer Salary Snapshot (2025)

Developer pay across LATAM varies by country, experience level, and even city. In general, capital cities and major tech hubs tend to offer higher compensation due to stronger demand, international employer presence, and higher living costs.

In Mexico, junior developers earn between $25 and $35 per hour, with rates rising significantly in major tech hubs like Mexico City, Guadalajara, and Monterrey. Mid-level engineers command $35 to $45 per hour, while senior developers can earn up to $80 per hour. Mexico remains one of the top choices for nearshore development due to its strong U.S. time zone alignment, deep talent pools, and increasing specialization in cloud and AI technologies.

Brazil offers a wide salary band with junior engineers earning $20 to $28 per hour, mid-level professionals earning $28 to $35, and senior developers commanding $40 to $60 per hour. Talent concentration is especially strong in cities like São Paulo, Rio de Janeiro, and Curitiba, making Brazil a reliable source for both frontend and backend expertise across industries.

In Argentina, hourly rates remain competitive—$18 to $25 for junior developers, $25 to $35 for mid-level roles, and $35 to $55 for senior positions. Developers in Buenos Aires and Córdoba often earn at the higher end of these ranges. Argentina is well known for its English proficiency, strong STEM education, and remote work maturity, making it a cost-effective option for international teams.

Colombia continues to grow as a tech hiring hub. Junior developers earn $20 to $30 per hour, mid-level professionals earn $35 to $50, and senior engineers can reach $70 per hour. With thriving ecosystems in Bogotá and Medellín, Colombia combines structured compensation bands with a rising number of venture-backed startups and technical training programs.

Chile offers some of the highest rates in Latin America, with junior developers earning $30 to $35 per hour, mid-level professionals commanding $40 to $60, and senior developers reaching up to $90 per hour. Santiago remains the central tech hub, with developers highly sought after for DevOps, cybersecurity, and data engineering skills—especially in enterprise and fintech sectors.

Freelance vs. Full-Time Cost

The cost of hiring a developer in LATAM depends not just on experience or location, but also on the engagement model. Here’s how freelance and full-time models typically compare:

Freelance Developers

Freelancers command higher hourly rates due to the flexibility and short-term nature of their contracts. These rates often include self-covered costs like taxes, health insurance, and equipment. Companies may pay a premium of 20–30% over full-time equivalents to secure high-quality freelance talent—especially for urgent or project-based work.

Full-Time Developers

Hiring full-time LATAM developers—either as direct employees or through nearshore staffing partners—tends to be more cost-effective in the long run. Annual salaries are lower than in the U.S., and developers are generally open to long-term commitments, offering better stability and institutional knowledge over time.

Staff Augmentation

Some companies choose a middle ground: staff augmentation. This model combines the reliability of dedicated full-time talent with the flexibility to scale teams up or down as business needs change. Rates are typically closer to full-time equivalents, but with the added benefit of easier ramp-up and lower hiring risks compared to freelancers.

Ultimately, the right model depends on your goals: freelancers for short bursts of expertise, full-time hires for stable growth, or augmentation to balance both. Understanding these options helps businesses budget more accurately and choose the path that fits their project timeline and strategic needs.ed with one-off freelance contracts, since engineers are pre-vetted, integrated into your processes, and committed to longer-term succes.

👋 Ready to tap into LATAM’s developer talent?

We’ll help you build and scale nearshore teams that deliver quality at competitive rates. Connect with us to find the right fit for your project.

Trusted by tech leaders at:

Why LATAM Rates Remain Competitive in 2025

Several factors keep LATAM rates attractive for global employers:

- Timezone Alignment – Overlaps with U.S. and Canadian working hours improve real-time communication and reduce project delays.

- High English Proficiency – Particularly in tech hubs like Buenos Aires, São Paulo, and Mexico City.

- Strong Talent Pipeline – Universities and bootcamps across LATAM produce a constant supply of skilled engineers.

- Agile Collaboration Culture – Many LATAM developers are trained and experienced in modern agile, DevOps, and product-focused environments.

This combination means companies can secure highly skilled developers without the productivity challenges sometimes seen in offshore regions with significant time zone differences.

Global Context

When compared globally, LATAM rates reveal a distinct competitive advantage. Developers in the region typically cost far less than their North American and Western European counterparts, while still offering stronger alignment and collaboration benefits than many offshore destinations in Asia or Eastern Europe.

- A mid-level developer in LATAM costs 30–50% less than in the U.S. or Western Europe.

- LATAM rates are generally 10–20% higher than some parts of Eastern Europe and Asia, but companies often find the collaboration benefits outweigh the cost difference.

This positions LATAM as a “sweet spot” for organizations looking for a blend of affordability, talent quality, and operational efficiency.

In 2025, LATAM continues to stand out as one of the best value regions for sourcing software development talent. With competitive hourly rates, strong technical expertise, and seamless time zone alignment with North America, the region offers businesses a unique blend of affordability and quality. By understanding how rates vary by country, experience tier, and specialized skills, companies can plan budgets more strategically and build the right mix of talent to support growth.

If your organization is considering nearshore development, Curotec can help you navigate the LATAM market and build a high-performing team tailored to your needs. From augmenting your existing staff to creating full, dedicated engineering squads, we connect you with vetted developers who deliver results.

👉 Ready to explore nearshore development in LATAM? Get in touch with Curotec today to discuss your goals and find the right fit for your projects